Know Everything About GST Return Forms and How to File the GSTR9 Form?

GST has changed the landscape of the Indian Tax System by incorporating an array of Indirect taxes under one platform. With the introduction of the GST bill, you can now file all the taxes levied in the supply of goods and services on a single platform. Every business has to file a GST Return form which furnishes details about the transactions and taxes paid over a period of time.

The GST Bill makes it mandatory for all the taxpayers to file Goods and Services Tax Return through GSTR forms available online. You can fill GSTR Forms, make payments and abide by the GST Bill from the convenience of your home. The online filing of GSTR has made the tax system in India transparent and helped maintain proper records of each transaction.

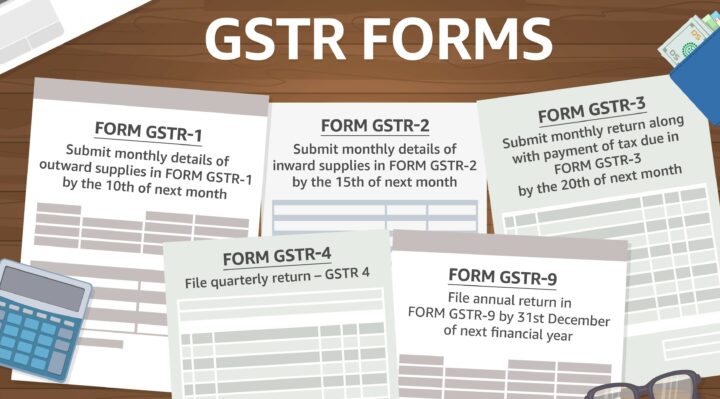

There are a total of 11 GSTR forms for different purposes. All taxpayers don’t have to fill each and every form. Individual taxpayers only have to fill four forms, namely GSTR1, GSTR2, GSTR3 and GSTR9. These forms are furnished to file monthly returns, annual returns, return for supply and return for purchases.

Other GSTR forms are specific to different taxpayers as specified in the GST Bill. These include returns for non-resident taxpayers, deducting TDS, etc. Here we discuss the purpose of each Goods and Services Tax Return form. You would also learn about filing the widely discussed annual returns form, GSTR9 as you read further.

GSTR1

GSTR1 is the return form that records details of every transaction regarding the supply of goods and services. GSTR1 fulfills the primary purpose of the GST Bill by registering every sales transaction of all the taxpayers.

You also have to report any debit or credit note issued to you on a monthly basis. In cases of small traders having a turnover of less than Rs. 1.5 crore, GSTR1 can be filed quarterly. You also have to mention the amendments to the GST invoice made over the previous month in GSTR1.

GSTR2

GSTR2 is the return form to register all the purchases of goods and services made by each taxpayer registered under GST. As specified in the GST Bill, GSTR2 is the direct consequence of GSTR1 since every purchase is the direct consequence of a sale. The seller can’t complete a transaction and file its return under GST without the buyer filling the GSTR2 form.

GSTR3

GSTR3 is the final report after successfully filing GSTR1 and GSTR2. It includes all the details of transactions under GSTR1 and GSTR2 regarding sales and purchase. It includes the complete details of sales and purchases made by a business in a month along with taxes paid, tax credit and liability.

GSTR4

GSTR4 is a tax return form under the GST Bill made specifically for taxpayers who have opted for Composition Scheme. Businesses with a turnover of less than Rs. 1.5 crore can opt for Composition Scheme though they only have to pay taxes on a fixed rate to the turnover declared annually.

GSTR5

A tax return form for non-resident taxpayers, GSTR5 is unique to businesses who carry out transactions internationally. It includes all the details of sales and purchase; taxes paid, credit notes, debit notes and liability. Non-resident businesses have to file GSTR5 monthly.

GSTR6

GSTR6 form under the GST Bill is made for Input Service Providers (ISP). Internet Service Providers have to reveal the details of input tax credit received and distributed over the month. They also have to fill in the details of distribution channels and documents issued to distribute input credit in GSTR6.

GSTR7

All the businesses that deduct tax at source have to file GSTR7. This form includes complete details of Taxes Deducted at Source (TDS) by companies, refunds claimed by customers or employees and TDS liability.

GSTR8

All businesses that operate through e-commerce and collecting tax at source (TCS) have to file GSTR7. GSTR7 will have all the details of the transactions made by the e-commerce business and TCS collected over those transactions.

GSTR9

GSTR9 is a mandatory Goods and Services Return form for every taxpayer registered under GST. This form has all the details of income and expenditure incurred by the business over the year. Every taxpayer has to file the Annual Returns by filling GSTR9 before 31st December for the financial year.

GSTR10

Those businesses that opt for cancellation of GST registration have to fill GSTR10 within 3 months of the cancellation date. You need to fill in the details of the cancellation order and tax payable at closing stock.

GSTR11

Every business or taxpayer who claims a refund of taxes paid on supplies has to fill GSTR11. You have to fill GSTR11 on 28th of the month following the said supply. You need to have a Unique Identification Number (UIN) to claim refunds and fill GSTR11.

How to fill GSTR9?

As discussed earlier, we will now guide you to file GST Returns-9 form Online. Although filling GSTR9 by yourself is a complicated process, we have listed this in a stepwise manner to make it easier for you.

- Login to GST portal and click on Returns Dashboard.

- Select Annual Returns.

- In the following columns, select the Financial Year and choose the online filling option to reach the next page.

- You can choose from filing an annual return or a Nil return. Nil return is for those users who have not made any transactions, don’t have credits or liability and have not claimed refund throughout the financial year.

- Select the Annual returns option otherwise.

- You can download the GSTR1, GSTR3B and GSTR9 summary from the next page.

- Now you have to enter the current details in all the columns in the tables for the current financial year.

- The columns will be auto-filled by the information from GSTR1 and GSTR3B. You just have to edit or change in case of any deviations in values over the year.

Click preview after filling all the details. - You can download the draft of GSTR9 form in PDF.

- GST portal will calculate if any late fee or liability is applicable.

- Make the late fee payments, if any, as Annual Returns cannot be filed without paying a late fee.

- You can then use Netbanking to pay for the liabilities.

- Proceed and select Authorised signatory on the next page.

- Click “File GSTR9” and select EVC method which verifies through OTP on registered mobile number.

Sudha is the senior publisher at Finance Glad. Sudha completed her education in BBA (Bachelor of Business Administration). She lives in Chennai. She is currently heading towards the banking topics. Sudha is an expert in analyzing and writing about most of the banks and credit card reviews. Sudha main hobbies and interests are reading, writing and watching the quality stuff over the internet. She usually wants to learn more productive stuff and share the best information to her readers over the internet via Finance Glad.