How to Check ICICI bank Credit Card Application Status Online

About ICICI Bank Credit Card?

Once you get used to the banking interface, you will soon realize how important a credit card is for you. It helps you in your emergency where you do not have any cash at hand so you can always rely on your credit card. Another essential function of a credit card is that you can avail several offers and unlock many reward points at the end of the year. ICICI bank is one of the prime banks of India and needless to say that it has a credit card facility. They offer you a platinum chip credit card with minimum 15% savings on banking and 1% fuel surcharge waiver. You can also avail various offers from well-known brands such as make my trip, goibibo, red bus, grofers, myntra, culinary treats and many more.

How to Check ICICI bank Credit Card Application Status Online?

Once you apply for an ICICI credit card, you can easily track the status of your application using both online and offline. However, the online process is more convenient and hassle-free. These are the steps to follow when tracking your application status.

- Visit loan.icicibank.com

- Fill the form on the left side of the page with your phone number which you have registered with the bank.

- You also need to fill in your date of birth and click on send OTP

- You will receive the one time password on your mobile number which you have given the application.

- Fill on the OTP on the next field.

- Click on continue.

- The next page will show you the status of your card.

How to Login into ICICI Bank Credit Card Online?

Follow the list to log in to ICICI bank credit card online

- You log in to icicibank.com

- Notice the login button on the upper right-hand corner of the page.

- Click on the login button.

- The next page will want your user id and password.

- Log in to your credit card system with the correct user id and password.

- Now you are ready to access your credit card online.

- If you cannot remember your password, then click on the forget your user id or password link.

- If you feel that your credit card has got locked then click on the user id locked link.

ICICI credit card online account helps you to manger your credit card and stay updated any time of the day and anywhere on the world. All you need is an internet connection. Through this account, you can check your card statement, transaction history, unbilled transactions, analyze your spends with Spends Analyzer and more.

How to Apply for ICICI Bank Credit Card via Bank Website with Required Documents?

You can apply for the ICICI credit card through such following steps:

- To apply for the credit card of ICICI online banking you first need to fill in an eligibility form.

- Go to iicibank.com where you will find the form.

- Fill in your details in the form which includes your current living city, date of birth, type of employment, and your relationship with ICICI bank that is whether you have your salary account or savings account in the bank or whether you have any form of a car loan or home loan with the bank. Even if you have no account with the bank, even that will do.

- Other than that you need to fill in name, email, mobile, company name.

- Click on the submit button.

- The bank will let you know whether your application for a credit card is eligible or not.

- Then the next step is to fill in the application form.

- You fill it up with your name, email id, mobile number, residence pin code, employment type, company name, a monthly salary which you get in hand.

- When you are done with these, select the type of credit card you want to take from the six choices they offer which are: Ferrari Platinum card, Ferrari signature card, Sapphire card, Rubyx credit card, and Coral credit card.

- Each card has different benefits. Choose the one that goes best with your income and lifestyle and needs.

- Receive approval from the bank in regards to your application.

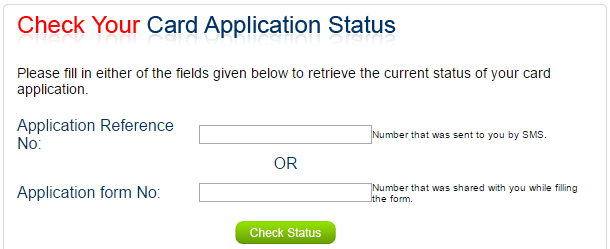

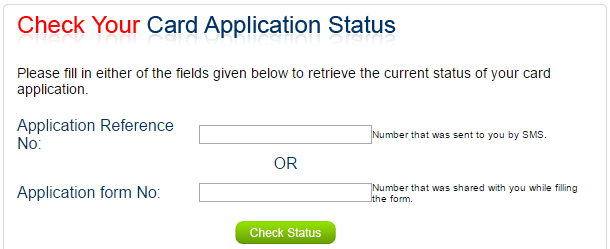

Track ICICI bank Credit Card Application Status using Application Reference Number and Mobile Number.

There are two ways of checking application status online. The one with the date of birth has been mentioned earlier. When you want to apply with application number then follow the given steps:

- Visit loan.icicibank.com

- There will appear a page on the right-hand side with mobile name, the application number, and mobile number.

- Click o continue at the end of the form

- As soon as you click on the continue button, your application status will appear provided if you have entered your application details correctly.

How to Pay the ICICI bank credit Card Bill Online?

You can pay your credit card using the net outstanding amount through online net banking. You can use your other bank accounts to pay your ICCI credit card bill. Payment will be useful in three working days. You can use Click to pay app to pay the amount. Follow these four simple steps to do the same:

- Select your bank from which you will like to pay the outstanding bank amount.

- Provide your credit card details where you need to select your card type. Enter your 16 digit card number

- You will be redirected to the payment interface page of your chosen bank.

- Enter Net banking user ID and password of your bank account

- Confirm payment details

- Your amount will be debited instantly.

- You will receive a transaction reference number o successful completion of a transaction.

Conclusion:

Now you know all the details of the credit card of a private sector bank in India. They offer a variety of credit card options which cater to the needs of customers of different categories. You need to be 23 and have a good credit score before you apply. Credit card calls in for a few responsibilities such as paying the outstanding amount on time and to choose a limit for your card which is reachable for you. If you keep these in your mind, then you are all ready to go ahead and get a ticket.

Sudha is the senior publisher at Finance Glad. Sudha completed her education in BBA (Bachelor of Business Administration). She lives in Chennai. She is currently heading towards the banking topics. Sudha is an expert in analyzing and writing about most of the banks and credit card reviews. Sudha main hobbies and interests are reading, writing and watching the quality stuff over the internet. She usually wants to learn more productive stuff and share the best information to her readers over the internet via Finance Glad.