Income Tax Calculator – Use Online Tax Calculator for FY 2018-2019

How to Calculate Income Tax?

Income tax is no doubt one of the most hassle-filled processes were you have to focus on lots of things in order to avoid any kind of confusion. But, apart from that calculation and doing all process is another time-consuming thing too. Well for making it more simple and easy, you get the calculate income tax which helps you in calculating the income which is taxable by nature and the liability you have over you tax. Not just that, it’s the tool which helps you in getting the most accurate, fast and simple option. Not just that there is a lot of hassle that you don’t have to face, as here you get everything in organize and simple form.

Well when it comes to planning the income tax, there are lots more factors that you need to consider. Not just that you also have to make sure that you have all the correct documents with you so your form won’t get rejected or because of any trouble for you. For understanding it better here is everything that will help you.

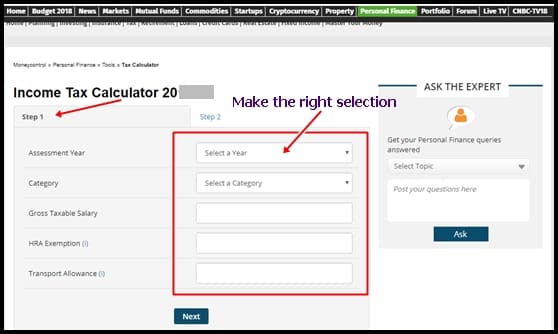

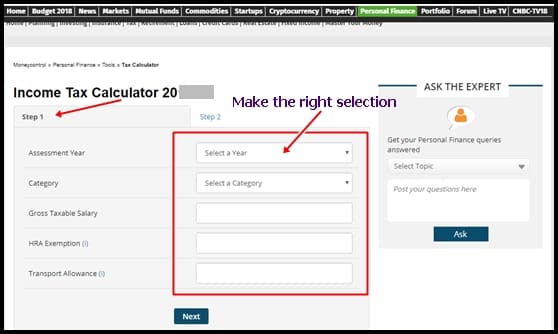

Online Income Tax Calculator possibilities:

When it comes to income tax calculator, there are lots of things that people should know. The income tax calculation results based on the information that you fill, which means it’s important to fill the details correctly without doing any kind of mistake. Not just that, every year it’s important for the salaried employees to calculate the taxes that they need to pay. There are different heads that come under the income heads and also there are other various terms that are also crucial. Well, paying higher bills is something that no one wants and that’s why they look for slabs where they can save some amount. For such a thing, it’s important for the taxpayers to submit all the information and proper documents to not create any kind of confusion.

Here is when the income tax calculator is needed. The tool helps in doing all the calculations without falling for any trouble. Along with that, online income tax calculator depends on the possibilities. Not just that, it’s important to make sure that you need to understand everything.

How to File an Income Tax online:

Well for making the income tax filing easier for the people, it’s the simplest option. However, lots of people have no idea about how they can do it online. There are basically some details and steps that you need to know before you go for summiting the form. Here are the steps that will help you:

1. visit the website first:

For starting the process, the first thing that you are going to need is to visit the official website of income tax. Here you need to create the e-filing account. For logging, you can use the PAN number

2. Link Aadhaar:

Well, it’s mandatory that you have to link your Aadhaar card once you log in to your account. You get an option link Aadhaar under your settings tab. Fill the asked questions and submit it

3. Get the form 26 AS:

You will get this form under the quick link. Well basically form 26 AS is a taxes summary that you paid all this financial year. Not just that, it also includes advance tax, TDS and self-assessment tax.

4. Download the ITR:

The next step that you are going to need to download the ITR, but make sure you choose the correct one. For help, you can also do some research.

5. Get the ITR excel utility and fill the information:

After that, you need to download the excel utility ITR. there will be some details that you need to fill make sure you don’t fill it wrong, for understanding better here are the details you are going to get :

- Your Name

- Your PAN

- Address

- Your Date of Birth

- Your Email ID

- Mobile number

- Option in choosing the original or revised return

- Taxable income (other)

- Taxes deducted

- Investments

- Your bank details

6. Calculate the taxes:

Once you fill the details, the next thing you need to do is to click on the validate button. After that, you have to calculate the tax.

7. Fill the details:

Make sure you paid all the taxes and get the Challan details. After that, you have to click on XML generate and save the XML file.

8. Go back to the IT website:

After coming back to your account, you have to upload the file you downloading and submit the digital signature of yours. Make sure you upload it correctly for avoiding any future hassle. Once you are done, click on the submit option. Here you will receive an acknowledgement. You have to print this out for continuing the next step

9. Digital signature:

After submitting everything, here you will get a digital signature which means your process is completed. However in case of not getting it, then you will get an ITR V form. You have to download the form and do your signature with blue ink and post it to the income tax office. Once your work is done you will get acknowledgement receipt via email or SMS.

Details that needed to file an Income Tax:

There are lots of forms that have been recently every year as the form is not completed or have incorrect information. For those who are going for filing their income tax, they should understand the details before they file. Along with that, it is also crucial to make sure that you are going according to the rules that have been set by the income tax. For not getting tangled up, here are the points that will help you:

- The first thing that you are going to need is your abstract bank statement

- The certificate of the salary which is issued by the employer as the proof of investment and 16 form

- The home loan certificate

- Your TDS certificate

- Any documents if you have on the purchase or the sale of investing or assets

- Proof of investment in the property

- Advance tax or if not that, then self-assessment tax. Basically, you need Challan of tax payment made

Well apart from this, there is other information that you are going to need. Along with the documents, you are also going to be asked to fill the personal information for calculating the income tax. For making sure that you don’t do anything wrong r submit anything which is not accurate, here is the list that will help you:

- Your name: the very first and important thing that you need to fill. However, don’t give the name which is not used on any official government paper. The filed require the name which is also written on your financial and governed records

- Email: the reports of the process will be sent on your email address, that’s why make sure you don’t give any wrong address

- Mobile number: for keeping the record, the mobile number is mandatory

- DOB: your date of birth or DOB is another crucial part, that why you have to give the exact date that is also written on the government IDS of yours. Also, it is for keeping the record but you have to give proofs to support the date.

- Gender: the tax slabs are different when it comes to gender.

- City: well, you will get a drop-down menu from which you will have to choose the city you are currently living. The reason behind this, the treatment of tax for rent house allowance depends on the city you are living. Not just that, it also varies if you are living in metro cities or non-metro cities.

Income Tax calculator FAQ:

There are lots of things that people have in their mind, here are few listed that will help you in understanding the income tax calculator better.

- what are the heads under which the taxpayer income is classified?

Ans. Well section 14 of income tax act, under which the taxpayer income is classified into five incomes, heads such as:

- Income from the Salary

- Income from the house property

- Income from the gains from the capital

- Income from the business’s profit and gain

- Income from any other source.

- how to calculate TDS on the salary?

Ans. For calculating the TDS, the individual’s current CTC is computed where different elements are added which includes an allowance for the medical, the basic salary, special allowance, dearness allowance etc.

- what did the gross total income mean?

Ans. The gross total income basically means the total income of an individual including all heads that are mentioned under the section.

Conclusion:

Income tax is one of the important and crucial things where you have to take lots of care. Not just it has its own benefits but also you get different other positive points too. Well with the help of income tax calculator you can calculate the liability in the simplest way. Along with that, it’s time-saving and makes sure that you don’t have to face any kind of hassle.

Sudha is the senior publisher at Finance Glad. Sudha completed her education in BBA (Bachelor of Business Administration). She lives in Chennai. She is currently heading towards the banking topics. Sudha is an expert in analyzing and writing about most of the banks and credit card reviews. Sudha main hobbies and interests are reading, writing and watching the quality stuff over the internet. She usually wants to learn more productive stuff and share the best information to her readers over the internet via Finance Glad.