An Overview of Itemized Deductions

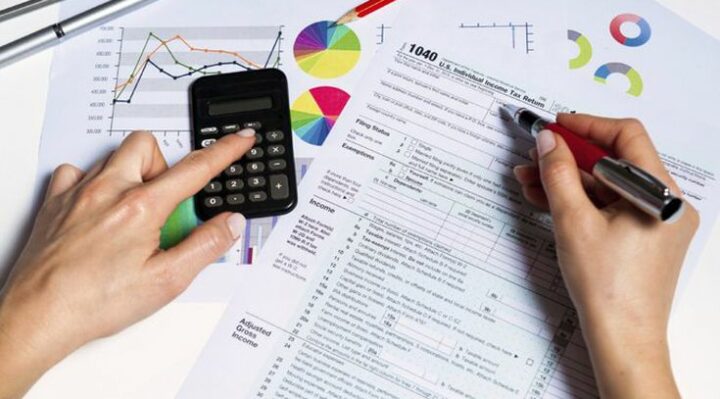

The direct taxpayer section in society is well aware of the standard deduction. It means the amounts that are canceled from such amount as they have invested in some projects that have the potential to help the society in various regards. Prior to the rise of the Tax Cuts and Jobs Act (TCJA), larger deductions could be claimed by common people through provisions of Itemized Deductions. In the article, we have processed a clear overhauling of the entire process.

Meaning of Itemization:

In a nutshell, Itemization would refer to the process of reporting the actual expenses for the allowable deductions. The reported expenses are then added and the sum id added to the net tax return. To enable the process to pave smoothly, a condensed record of all the expenses must have to be maintained, i.e. supporting receipts and other documents are required to be produced for further legitimizing of the expenses.

Confusion over Standard and Itemized Deduction:

It is hard for a common person whether his earning would enable him/her to apply for Itemized Deductions and there is nothing to ashamed of or wonder in it. The professional tax consultant has a role to play. Based on the information about earning entered by the person, it is easy for a professional tax consultant or a professional App to find out the deductions and categorize those.

Must Read – How to Save Income Tax in India

The calculation depends entirely on the pro-rate of profit from the tax assessment. After preparing the return, the net output is forwarded for comparing the available deductions and find out the best of it. Most of the folks find the best suitability with standard deductions; however, there are few people for whom Itemized Deductions stand good.

Why most payers go with Standard Deduction?

It is traditionally found that most of the taxpayers go after the Standard Deduction, despite being high earning and having scopes to channel discounts in various avenues.

They say that undergoing such process and claiming deductions demands higher legal knowledge that they do not possess. The legal and tax consultants charge high to offer consultation in these regards. Therefore, going with the Standard Deduction concept seems more profitable.

Categories where Itemized Deductions are offered:

Itemized Deductions can be claimed in the following categories:

- Medical Expenses

- State Income Taxes

- Local Income Taxes

- The interest of the home mortgage

- Mortgage Insurance Premiums

- Gifts to charity

- Theft losses

- Casualty

- Real Estate Taxes

Rules for imposing Itemized Deductions limit

Medical Expense

Under this profile, the cost of Itemized Deductions will include the value of the Insurance Premium if the employer did not reimburse for the same. Other medical care costs are also included. The taxpayer will be eligible to deduction of the portion that exceeds 7.5% of the adjusted gross earnings. The addition of many such expenses may exceed the Standard Deduction.

Read More – How to Calculate Taxes on your Bitcoins?

The Government Taxes

Under this provision, TCJA has limited the amount if Itemized Deductions to a maximum of $10000. The money amounted to $5000 is the maximum limit if the return is submitted separately by a married person. The deduction of $10000 is collective bargaining.

Gifts to Charities

Generosity is commonly supported and TCJA has also amended itself in parity to the sentiment. The contributions are limited to maximum deductions – and the Itemized Deductions limit for such cases is bound up to 50% of the Adjusted Gross Income. However, it has gone to 60% in many cases post-2018.

Mortgage Interest

TCJA has limited the mortgage interest deduction at debts of $750000. The Itemized Deductions, in this case, was reduced by $250000 in 2018 from the previous year.

For married taxpayers submitting separate returns, the limit has been reduced to $375000. The deduction is, however, restricted to deduction in acquisition debt only.

Casualty and Theft Losses

Such restriction has been limited by TCJA to the losses sustained due to events that have occurred in locations previously declared as disaster areas by the president of the USA.

Conclusion:

Laws are always subject to change. Therefore, the information we have put forward may cease to be relevant at any given point in time. In case you need clarification or need some resolution to any issue that is tempting you from time, consult a professional tax practitioner. The person or firm will be able to provide the most legitimate advice.

Matters of Legality are the stuff of solicitation.

FinancesGlad is India’s fastest growing online publication Blog for Entrepreneurs, Small business, Bloggers and personal finance experts.