PPF Calculator – How to Calculate PPF Interest Rate, Returns & Maturity

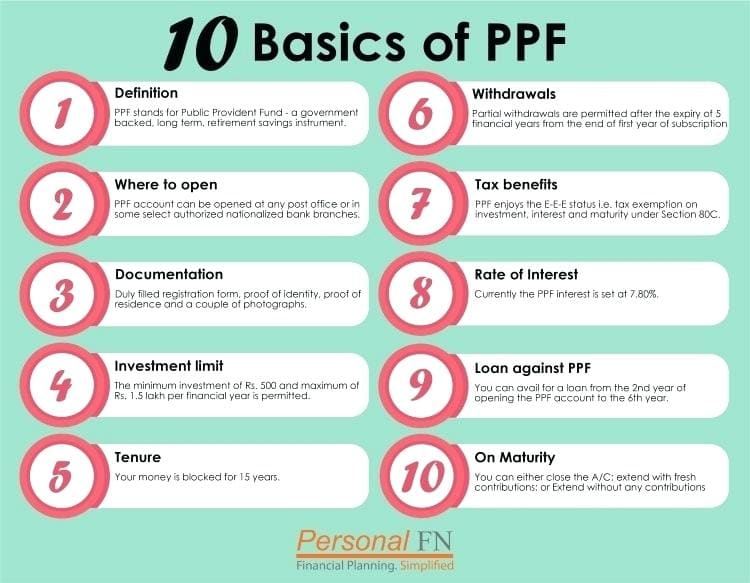

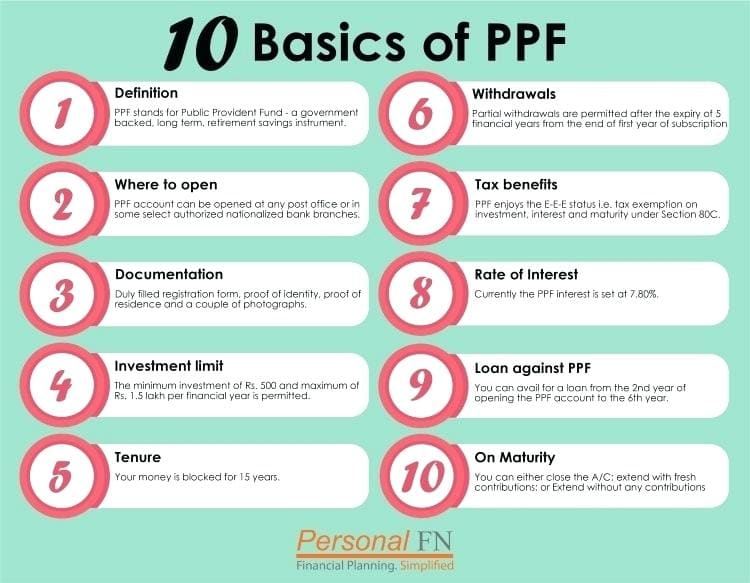

PPF Stands for Public Provident Fund which may sound quite complicated but it is important to consider among very relatable concepts regarding finance. PPF today, surely is the tax saving as well as money saving schemes which are proposed by the National Saving Institute of the Ministry of Finance under Central Government. It has been started in the year 1968.

The goals for PPF are to start moving some particular amount of saving from your expense towards an investment where you can cent per cent returns along with income tax benefits as well. The interest rate on PPF is 8.1% per annum which is also tax-free under 80C that says interests earned is completely exempted without any implying limits. Any Indian resident where it should be not minor or NRIs are allowed to open a bank account with any nationalized bank like Punjab National Bank, State Bank of India, Central Bank of India etc, post office or any other Private but authorized banks like HDFC, ICICI, Axis Bank etc. The duration along the PPF is 15 years where the individual is supposed to deposit any amount in-between Rs. 500 to 1.5 lacs per year. Rs. 500 is minimum whereas 1.5 lac is the maximum amount for deposition to one’s PPF account.

What is the PPF Calculator?

If you are thinking to invest in PPF or looking for long-term financial security plans with PPF accounting, PPF calculators are the best chance for you to anticipate the returns, to compute the returns in actual figures. It is the tool to compute various calculations involved in PPF accounting whether it is to find out the returns you get after maturity on a certain fixed/ variable on monthly/yearly deposit-basis. It gives you a quite perfect estimate on the returns, suppose deposit amounts, interests, taxations and other aspects of it.

How does a PPF Calculator Works?

PPF Calculator is an online financial tool where it can be used to calculate or compute returns on the investment you have made or going to make in the PPF account. PPF account is there to provide a smart investment solution and tax saving plan so you can have a better idea about your investments and most certainly your future financial plans accordingly. PPF calculator is able to calculate the amount within the seconds on your returns regarding the investment you suppose to make or already made. PPF Calculator can help you to decide what amount you should invest or actually what monthly investment or periodically investment amount you already made can lead to reaching the certain returns you will receive after some duration. You need to feed some details about your investment patterns to the PPF Calculator to give you desirable results. It will not just only calculate your interest on the invested money but also the withdrawn limit you will be allowed along with the amount of loan which you can take against your PPF account as well.

You need to know that the money you have invested or will invest in your PPF account is or will be blocked for the certain period such as for 15 years but there will be some limited withdrawal facility which works with certain conditions only. It is better you get an estimated idea about how much your money is growing in your PPF accounts to give a better idea of returns as well as limited conditionals returns in-between as well. PPF calculator does that for you where you can calculate choosing two kinds of options; one is the fixed investment amount for 15 years and second is the variable investments over the period.

How to Open a PPF Account?

Here are the following steps you should follow to open a PPF account in an authorized private bank, nationalized bank or post-office.

- First, you have to choose the kind of bank in which you want to open the PPF account because it can make difference to the plans. You can go for nationalized banks like State Bank of India (SBI), Punjab National Bank (PNB) or Central Bank of India or choose authorized private banks like HDFC, ICICI, Kotak Mahindra Bank, Axis Bank and more. Also, there is an option to open a PPF account in a post office.

- You need to figure out that minimum amount required to invest or maintain in your PPF account is Rs. 500 per year.

- The maximum amount on other hand is Rs, 1, 50, 000 which you can deposit in your PPF account. If you access that threshold amount in that financial year, it will not earn any interest. Also, you need to remember that you deposit whole supposedly amounts throughout the year by depositing Lumpsum amounts or maximum 12 instalments.

- A total amount of your PPF account can be only withdrawn at maturity after the period of 15 years.

- It is also important to know that the interest you earn on PPF account is tax-exempted. So it is can be a great investment option for the long-term plan. The annual contribution you made to your PPF account falls under the tax deductions under section 80C, income tax rules & regulations. The tax concession cap is at 150,000 of your total income in that particular financial year.

Types of PPF Calculators:

There are different types of PPF calculators which are customized to compute the PPF returns on the certain preferences. It is basically to find out various aspects of the PPF account through the maturity years. It could be about the loan abilities, investment-based or withdrawal-based as well. Well, there are basically 7 types of PPF calculators which helps you to compute 7 different types of calculations needed to be done on based on PPF. It will help you to understand better about the returns you get, the interest rate on your deposited amount, how much return you get on how much monthly or yearly investments, benefits, loan possibilities and much more.

- PPF Fixed Monthly Investment Calculator

- PPF Benefits Calculator

- PPF Available Loan Calculator

- PPF Fixed Yearly Investment Calculator

- PPF Available Withdrawal Calculator

- PPF Variable Yearly Investment Calculator

- PPF Maturity Calculator

- PPF Fixed Monthly Investment Calculator

What are the Benefits of PPF Calculator:

PPF Calculators are the best chances for individuals to know more about their PPF Accounts. It is better chance for you to anticipate and compute the figures regarding the PPF investments. There are different types of calculators as well to serve certain preferences or aspects whether it could finding the interests you are earning on the account or it could be the monthly or yearly fixed investment amount to be paid for a certain return after 15 years.

- PPF Calculators suggest you about the income tax liability even before you invest in it. Also tells you about the income tax liabilities after you invested, it could be on the interest you earn or the return you will get after the maturity period.

- It also computes the tax-free income of your total earnings in the financial year as to how much annual contribution can exempt how much of the tax applied on you for that year.

- The interest rate you are earning on the PPF account balance or the amount you are depositing as well. It will give you a pre-deposit idea and you can deposit accordingly to the benefits.

FAQ’s on PPF Calculator:

Can I deposit on monthly basis in a PPF Account?

Yes, you can either deposit the money in small instalments through the year in monthly intervals just like in SIP (Systematic Investment Plan) or you can deposit it at one shot as well. The maximum instalments could be only 12 times a year of different amounts.

What If I invest more than 1.5 lac in a year?

Any amount invested above the 1.5 lac in a year will earn any interest or be eligible for tax exemption for that year as well.

What If I forget to deposit any money in my PPF account for a year?

Your PPF account will be taken as de-activated. You can re-activate it through with paying fine of Rs. 50 for each year you missed or and minimum subscription of Rs. 500 per year you missed as well.

Can I have more than one PPF account?

No, you cannot have more than one PPF account at a time.

Can I have a joint PPF account?

No, you cannot have joint PPF account.

How to use PPF Calculator?

There are different types of PPF calculators where you can get these results:

1. Returns after maturity on a certain fixed monthly/yearly amounts

2. The interest you earn on PPF account

3. Loan possibilities

4. Tax benefits

You just need to feed the amount you can pay monthly or yearly to get these results. You can choose the duration minimum 15 years to maximum 5o years.

Conclusion:

PPF accounts are the best saving scheme, especially as retirement financial security and preferable for those who are not into corporate job having EPF (Employee Provident Fund). It is least risky, easy payments, flexible, low payments and high returns like a lot of benefits. You can deposit a minimum Rs. 500 and maximum 1.5 lac annually either in 12 instalments or at once for that year. The interest you earn on that will be tax exempt as well. Various types of PPF calculators can compute how much you deposit to get certain returns after maturity. You can also calculate loan possibilities, tax exemption, monthly/ yearly fixed deposit amounts and much more.

Sudha is the senior publisher at Finance Glad. Sudha completed her education in BBA (Bachelor of Business Administration). She lives in Chennai. She is currently heading towards the banking topics. Sudha is an expert in analyzing and writing about most of the banks and credit card reviews. Sudha main hobbies and interests are reading, writing and watching the quality stuff over the internet. She usually wants to learn more productive stuff and share the best information to her readers over the internet via Finance Glad.