Will Home Loan Interest Rates Increase in 2021?

There is nothing like the feeling of owning a home. Many people plan to buy a home after they settle down in life or start earning a stable income. However, for the most part, a home loan helps in accomplishing this goal. A housing loan not only enables you to borrow a large sum but also allows you to pay it over a long period. When you obtain this amount from a lender, you must also pay a certain interest rate over the borrowed sum.

Recently, you must have observed the rate of interest decreasing across most banks, a lucrative moment for individuals to buy a home. But the question of the interest rate movements in 2021 still remains. So, let us explore this aspect further.

A Decline in Repo Rates

The Monetary Policy Committee (MPC) of RBI revealed that the repo rate would remain unchanged at 4 % to reduce the impact of the pandemic. The movement of repo rates over the past couple of years has decreased with it staying at 4 per cent since May 2020. The reduced rates were kept down to support the economic growth of the country and development as well as increase liquidity. Such a decline in the repo rates causes banks to reduce their lending rates in turn benefiting the loan borrowers. Thus, with the ongoing decline in repo rate, the home loan interest rates for new borrowers have also come down.

Impact on Home Loan Interest Rates

You can get a home loan at an interest rate of around 7 per cent, which was previously lower during the beginning of the pandemic. Banks that we’re offering a lower rate of interest with a waiver on processing fees to attract loan borrowers have now restored their original interest rates.

But will the rate of interest for home loans dip even further when the inflation rate is still high? To improve economic growth and keep inflation in control, the interest rates are likely to remain low. Thus, borrowers could expect the rate of interest to possibly go down, benefiting you in repaying the home loan.

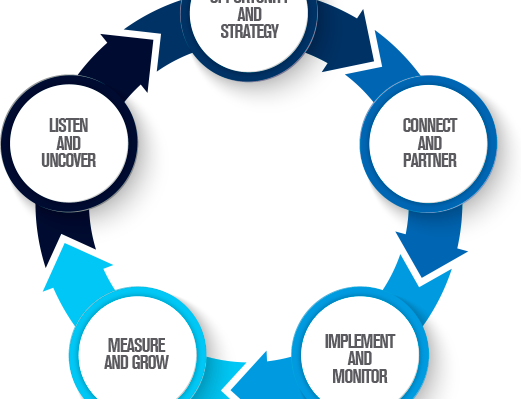

Home Loan Strategy for 2021

But regardless of this, as existing and new borrowers, you must have some strategies to pay off your home loan without much trouble. One way to reduce the financial burden of home loans amidst the current situation is through prepayment. The movement of the interest rate may not be predictable and thus, paying some additional amount apart from your home loan EMIs can go a long way. The prepayment amount goes towards the principal of your loan, in turn reducing the interest payment. It is ideal to dedicate a lump sum in the initial years of your home loan, as interest cost is higher in the first couple of years.

With the current reduced home loan interest rates, you can fulfil your dream of purchasing a house. But it is recommended to plan out your finances and take your savings into account as well. As this is the best time to opt for a home loan, do not miss out on the opportunity of low rates.

FinancesGlad is India’s fastest growing online publication Blog for Entrepreneurs, Small business, Bloggers and personal finance experts.