How to Plan Your Retirement with Mutual Funds

Retirement inspires a feeling of comfort, satisfaction, and relaxation, but only if you are financially secure at the time of it. This is because while you may love to hang up your boots on the 9-5 rut, you would still need a regular income to sustain the same lifestyle post-retirement. You would also need to protect your savings from getting eroded by inflation. Further, you may have to bear higher healthcare expenses as you age, apart from other discretionary spends.

So, while you plan for every other thing in your life, retirement planning should definitely be a priority if you want to enjoy your golden retirement years.

How much do I need to save for my retirement?

Your retirement corpus is not a standard figure. The amount you would need for retirement depends on how much you need at the moment to support your current lifestyle and whether you intend to live in the same manner in the future as well. Also, you need to take into account the rate of return on your investments and the inflation rate. To arrive at a figure, you would need to estimate your current monthly expenses, the number of years to retirement, the expected rate of return from your savings, and the expected inflation rate. Once you arrive at the future value of your monthly requirement, multiple this by 12 to know the annual amount. Finally, multiply the annual figure with your life expectancy and adjust for inflation. This is the approximate corpus you would need at the time of retirement. There are many retirement calculators available online that can help you calculate the approximate retirement corpus.

Now, simply back-calculate to figure out the amount you would need to start investing today, using an expected rate of return.

Retirement funds can be a wise choice for retirement planning

Mutual funds are a preferred investment avenue by many investors to achieve various financial goals including retirement. Mutual Funds come with the benefits of professional management and easy access to financial markets.Further, mutual funds are available across asset classes,so you have multiple investment options based on your risk appetite.

Fund houses have dedicated schemes for the purpose of retirement planning. Most of these schemes come with a range of options that suit varying risk profiles, that is,they differ in terms of asset allocation. For example, aggressive retirement plans mostly invest in equity and are suited for young investors. On the other hand, conservative retirement plans invest a greater proportion in debt securities and are suitable for older investors who are close to retirement. Moderate retirement plans invest in a mix of debt and equity and are suited for those who are neither too young to retire nor too close to retirement.

Many of these funds come with the auto-switch feature, wherein, if you cross a certain age threshold, your money is automatically switched to the less aggressive plan, constantly aligning your investments with your risk profile.

Start early to make the most of these funds

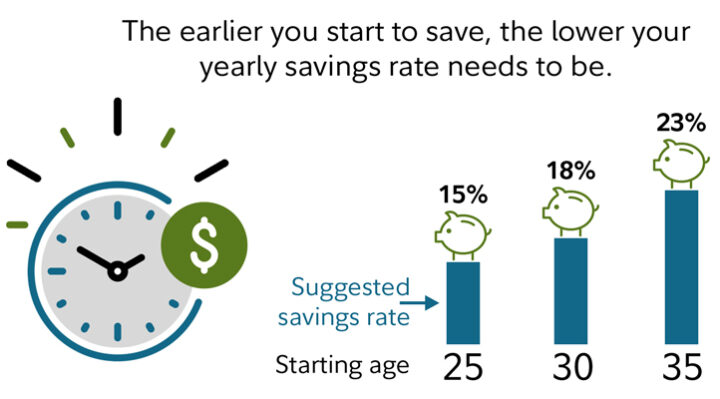

As with all financial goals, it is best to start your retirement planning early. The obvious benefit of starting early is that your money gets more time to grow due to compounding. You may also consider investing towards your retirement through a systematic investment plan (SIP) which helps iron out volatility, eliminates the hassle of timing the market, and allows you to make small investments periodically.

Who knows, you may even be able to retire earlier than you planned to if you start investing towards your retirement today!

FinancesGlad is India’s fastest growing online publication Blog for Entrepreneurs, Small business, Bloggers and personal finance experts.