What is the fed interest rate? Why it changes

The federal funds rate is the target interest rate fixed by the FOMC at which profitable banks borrow and lend their additional reserves to each other overnight. FOMC groups a target federal funds rate eight times a year, based on main economic conditions. The fed interest rate can impact short-term rates on customer loans and credit cards and also impact the stock market. Banks and other stock organizations are fixed to preserve non-interest-bearing financial records at Federal Reserve banks to confirm that they will have sufficient cash to refugeinvestors’ withdrawals and other liabilities. The amount of money a bank must keep in its Fed account is known as a reserve requirement and is based on a proportion of the bank’s total deposits.

How Does Fed Funds Works?

The Federal Reserve needs that banks retain an amount on hand each night. This standby requirement prevents them from lending out every single dollar they acquire. It makes sure they have plentiful cash on hand to start each business day. Banks hold those reserves either at the local Fed branch office or in their domes. If a bank is short of cash at the end of the day, it borrows from a bank with additional money. That’s where the fed funds rate comes in. It is the rate banks charge each other for immediate loans to meet these reserve balances. The amount loaned and borrowed is referred to as the federal funds.

Why fed Interest Rates Change?

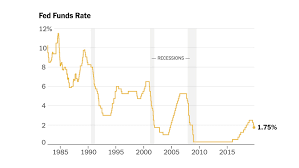

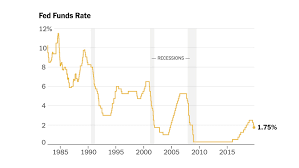

Changing the federal funds rate impacts the money supply; starts with banks and ultimately dropping down to consumers. The Fed lowers interest rates in order to encourage economic growth. Lower financing costs can boost borrowing and investing. However, when rates are too low, they can branch excessive growth and maybe inflation. Inflation eats away at buying power and could undermine the sustainability of the desired economic expansion. On the other hand, when there is too much development, the Fed will increase interest rates. Rate growths are used to slow rise and return growth to more bearable levels. Rates cannot get too high since more expensive financing could lead the economy into a period of slow growth or even contraction.

Conclusion

The fed interest rate is one of the most important interest rates in the U.S. economy since it moves economic and financial conditions, which in turn have a manner on serious features of the broader economy including service, growth, and inflation. The rate also impacts short-term interest rates, although indirectly, for everything from home and automobile loans to credit cards, as moneylenders often set their rates based on the major loading rate. The prime rate is the rate banks charge their most creditworthy borrowers and is influenced by the federal funds rate too. Investors keep a close watch on the federal funds rate, as well. The stock market usually reacts very powerfully to changes in the target rate. For instance, even a small decline in the rate can swift the market to leap higher as the borrowing costs for companies get lower. Many stock predictors pay specific attention to statements by members of the FOMC to try to get a sense of where the target rate might be regulated.

Sudha is the senior publisher at Finance Glad. Sudha completed her education in BBA (Bachelor of Business Administration). She lives in Chennai. She is currently heading towards the banking topics. Sudha is an expert in analyzing and writing about most of the banks and credit card reviews. Sudha main hobbies and interests are reading, writing and watching the quality stuff over the internet. She usually wants to learn more productive stuff and share the best information to her readers over the internet via Finance Glad.