Digit Review – Making a Saving Habit by Texting

Digit Review: Digit surveys can assist you with beginning sparing without contributing a huge amount of time and exertion. It assists keep with following you’re going through and decides how much cash you need to spare. It at that point goes above and beyond and makes programmed withdrawals from your financial records to your investment account.

The fundamental thought behind this application is to empower you to set aside your cash consequently without you investing additional energy and exertion. This digit audit is developing quickly as a result of its capacity to help individuals spare, and the way that it is rapidly changing their conduct. What makes it one of a kind is this is a robotized framework, and you truly don’t need to lift a finger. In this audit, we take a gander at how you can set your reserve funds up with this application among different highlights it brings to the table.

Automatic Saving Money:

This is a lot of cash on the off chance that you haven’t been sparing before. Digit survey’s primary capacity is to assist kick with the beginning you’re sparing society. Individuals neglect to spare since they most likely never truly began on the propensity. This makes for you the motivation to make the change from a non-saver to a saver. The primary advantage of the application is putting something aside for non-savers. This is no little accomplishment either. The latest Go Banking study demonstrated that 55% of Americans don’t spare or spare under 1,500. On the off chance that you are a piece of this gathering, the Digit could truly help you. It will assist you in setting aside cash without any problem.

Must Check – United Explorer Card – A Complete Overview

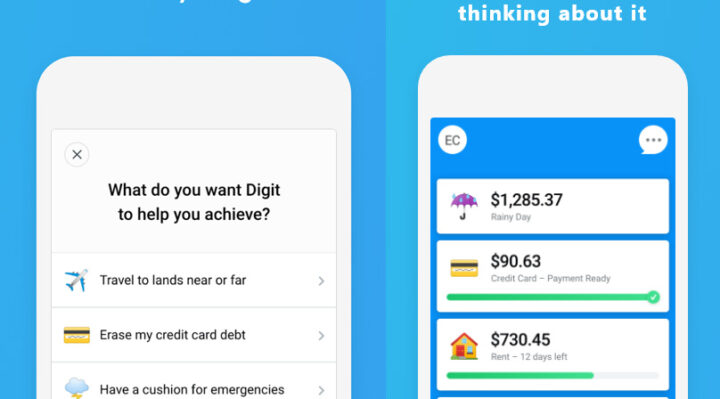

The digit consequently decides for you the most secure sum that you can pull back from your financial records, and this is typically founded on your way of life, your ways of managing money, and pay. It will do this without your information at all. DIGIT assists governments with turning out to be more resident-driven, through our easy to understand cloud programming, shrewd information examination, and spotlight on versatile. Solicitation your demo and find it. At the point when you join with this application, you ought to interface your financial records quickly; it will at that point audit your ways of managing money for you and think of a sparing project dependent on what will be found. It is likewise just accessible to clients in the US and their banks.

Digit Account Setup Method:

At the point when you open the record, you will begin by setting the base parity for your financial records. This is finished by essentially messaging “Least,” to Digit. They will at that point suggest setting a base limit of state, 250. This is anyway truly up to you. You will at that point be required to add a second client to your record. This individual will have the option to utilize the record similarly you do, however, they won’t be signed into the organization dashboard or roll out any improvements to your record. This is the sparing record where withdrawals from your financial records will be spared. This is generally alluded to as “The blustery day finance.” You are allowed to pull back the cash from the record at whatever point you wish and keep it into a sparing record of your decision.

Also, Check – Capital One 360 – A Complete Overview

Savings Control Systems:

You can manage the amount you spare with the application. For instance, if you need to spare more than the application suggests, you can send the message Save More, to Digit review. They will at that point increment the cash that is being spared, and if you happen to alter your perspective, again communicate something specific “Spare Less,” to Digit, and your investment funds will be reestablished back to the base sum. On the off chance that you wish to quit putting something aside for some time, send the message Pause and the digit will quit putting something aside for you.

Conclusion:

So, this is a Digit Review, It is so imperative to assume responsibility for your accounts, and this is actually what the application accomplishes for you. It will free your life up to sparing open doors you never knew existed. This application is incredible if you attempted to spare previously and seen the time and exertion required as a lot to deal with. Look at their site on the off chance that you need to discover more about what they’re about before you choose whether or not to join.

FinancesGlad is India’s fastest growing online publication Blog for Entrepreneurs, Small business, Bloggers and personal finance experts.